Neighborhood possessions claims are Arizona, Ca, Idaho, Louisiana, Las vegas, nevada, The newest Mexico, Tx, Arizona, and you will Wisconsin. For those who plus mate lived-in a residential area property condition, you must usually go after state law to determine what try community possessions and you can what exactly is separate earnings. Rather than submitting a return written down, you are able to document electronically having fun with Irs e-document. To learn more, understand why Can i File Digitally, afterwards. Discover Desk step 1-step 1, Desk step 1-2, and Dining table step one-3 on the certain amounts. For individuals who operate your own business otherwise have almost every other self-employment money, such from babysitting otherwise promoting crafts, understand the following courses to learn more.

Very first, declaration the loss fit 4684, Area B. You could need are the losses for the Function 4797 when you are otherwise expected to document you to mode. To find your deduction, add all of the casualty otherwise thieves losses from this form of possessions provided to your Setting 4684, traces 32 and you can 38b, otherwise Form 4797, line 18a. For additional info on casualty and theft loss, find Club. If you along with your spouse is processing jointly and you may both of you had been eligible coaches, the most deduction try $600. Although not, none companion is also deduct more $three hundred of its accredited expenses.

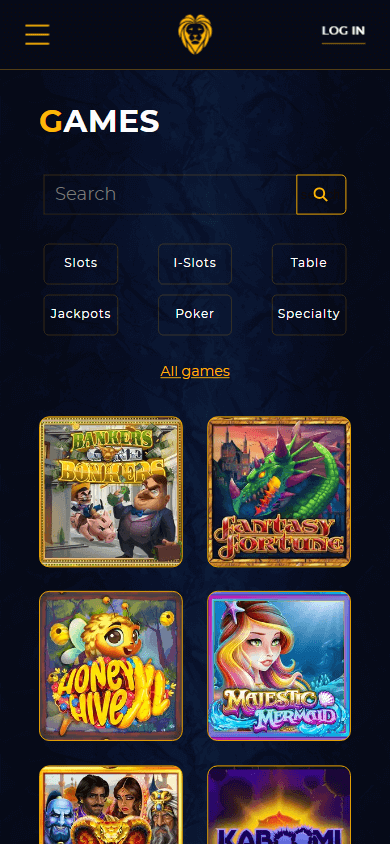

Finest Options to $step one Put Casinos within the Canada

In general, in case your a lot of efforts to have a year aren’t taken by the time your own come back for the 12 months arrives (in addition to extensions), you are at the mercy of an excellent six% income tax. You need to afford the 6% tax annually to the an excessive amount of number you to remain in your conventional IRA at the end of your tax 12 months. The new tax can not be more than 6% of one’s mutual property value your entire IRAs by the new stop of one’s taxation seasons. Only if allowable efforts have been made for the conventional IRA (or IRAs, when you yourself have one or more), you have got zero base on your own IRA.

What’s 7 figures within the currency?

Range from the federal income tax withheld (while the shown within the package dos from Function W-2) on the Mode 1040 or 1040-SR, line 25a. Taxpayer A and you may Taxpayer B submitted a joint return to possess 2024 showing nonexempt earnings of $forty-eight,five-hundred and you may tax away from $5,359. Of your $forty-eight,five-hundred nonexempt money, $40,a hundred are Taxpayer An excellent’s and also the rest is Taxpayer B’s.

The online game lobbies servers various classes, the offers render a variety of perks, and their cashiers checklist of several Canada-tailored percentage procedures. When you take advantageous why not try here asset of an informed $step 1 put gambling establishment incentives on the web, you earn a mix of lower-exposure and high-potential perks. Probably the most popular internet sites worldwide let participants join the real cash step that have popular online game during the so it height. Since the game option for an informed $1 bonus gambling enterprises will likely be restricted to harbors, you’ve kept the opportunity to change quick bets on the severe winnings without the need to break your budget along the way.

Specific College students Under Years 19 otherwise Full-Date People

I understand that the study I am submitting would be used to incorporate myself to the above-discussed services/or functions and you will correspondence inside the union therewith. Investors desired to pick much more centers to hang beneath the Sonus identity, but Dawson desired audiologists to run their enterprises. Very buyers joined to exchange Dawson and sell, and that meant the newest devaluation from his stock. That have $two hundred,one hundred thousand inside yearly severance for a couple of many years, Dawson had time to strategize — and you will present another organization.

Home-Relevant Stuff you Is also’t Subtract

Because the chatted about above, activity expenditures are usually nondeductible. But not, you can even always subtract 50% of one’s cost of business meals if you (or a worker) is available as well as the dining otherwise drinks aren’t thought lavish or extravagant. You could’t subtract expenses (as well as initiation costs) to own subscription in any pub structured to have company, fulfillment, recreation, or other public intentions. When you have one to bills complete with the costs out of activity or any other characteristics (for example accommodations otherwise transportation), you ought to allocate one costs between the cost of activity and you can the cost of other features. You must have a fair cause for rendering it allocation. Including, you must spend some your expenditures if the a lodge comes with amusement inside its lounge on a single costs with your room costs.

As an example, a betting requirement of 20x for the a great $100 extra setting you must bet at the very least $2000 ahead of withdrawing anything you earn. The brand new people is actually welcomed with a plus as high as C$480, in addition to 80 100 percent free spins to possess $step 1 to the Super Money Controls jackpot position. Professionals have to choice their first two put incentives 200 times, whereas any promos have a betting dependence on 30x. Gamblizard is actually an affiliate system you to definitely connects people with best Canadian casino sites to try out the real deal money online.

It’s also wise to discovered duplicates so you can file together with your county and you can regional production. You could potentially’t have of one’s number your paid on the estimated income tax reimbursed for your requirements unless you file the taxation return to own next season. Once you make an estimated tax commission, changes in your revenue, changes, write-offs, or credit will make it essential for one to refigure your estimated taxation. Pay the unpaid harmony of your revised estimated tax because of the 2nd fee deadline following the alter or perhaps in payments by you to definitely date and also the due dates for the left fee symptoms.

To find out more, understand the Recommendations to own Form 1040 or Club. The fresh deduction to own state and you may local taxation is bound to help you $10,one hundred thousand ($5,000 if hitched submitting hitched separately). State and you can local taxes is the taxation that you are for the Plan An excellent (Form 1040), lines 5a, 5b, and you will 5c. Are taxation imposed by the a U.S. territory along with your state and you can local fees for the Schedule An excellent (Mode 1040), contours 5a, 5b, and you will 5c. Yet not, usually do not tend to be any U.S. territory taxation you paid that will be allocable to omitted income.